inheritance tax rate indiana

The Probate Process In Indiana Inheritance Law. Inheritance and Estate Tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A federal estate tax ranging from 18 to 40 applies to all estates worth more than.

. In Maryland the tax is only levied if the estates total value is more than 30000. Indiana does not have an inheritance tax nor does it have a gift tax. Indiana taxes capital gains at the same rate as other income 323.

Keep reading for all the most recent estate and inheritance tax rates by state. Fortunately Indiana is no. The top inheritance tax rate is 15 percent no exemption threshold Kansas.

Indiana doesnt have an inheritance or estate tax. However be sure you remember to file the following. Whereas the estate of the deceased is liable for the.

State Inheritance Estate Tax. The Iowa tax only applies to inheritances resulting from estates worth more than 25000. States have typically thought of these taxes as a way to increase their revenues.

Your estate would be subject to federal gift and estate taxes for the combined value of 10 million at a tax rate of 40 percent. Inheritance Tax Rate Indiana. 430 pm EST or via our mailing address.

This number doubles to 224 million for married couples. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

The top inheritance tax rate is 16. There is no federal inheritance tax but there is a federal estate tax. Capital Gains Taxes.

The federal estate tax rates can vary between 18-40. However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am.

Tax rates can change from one year to the next. 45 percent on transfers to direct descendants and lineal heirs. Therefore without any deductions or planning ahead for the impact of taxes on your.

Indiana has a flat state. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

Indiana has a three class inheritance tax system and the exemptions and tax rates. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. There is also a tax called the inheritance tax.

Only 17 states have an additional inheritance or estate tax. People who receive less than 112 million as part of an estate can exclude all of it from their taxes. Exemption threshold for class b beneficiaries.

No estate tax or inheritance tax. An Indianapolis estate planning attorney at Frank Kraft discusses whether you need to worry about an Indiana inheritance tax. The act was amended in 1915 1917and 1919.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt. Up to 25 cash back Each beneficiary except those who are entirely exempt from the tax must pay tax on the amount he or she inherited minus the exempt amount. Inheritance tax applies to assets after they are passed on to a persons heirs.

Inheritance tax usually applies when. Married couples can avoid taxes as long as the estate is valued at. More information can be found in our Inheritance Tax FAQs.

If you inherited an immovable property youll also need to pay property taxes. State inheritance tax rates range from 1 up to 16. Indiana Department of Revenue.

No estate tax or inheritance tax. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. Based on the difference between the maximum State Death Tax Credit allowable at the federal level and the amount paid in state Inheritance Tax.

While it typically gets a bad rap probate was added into Indiana inheritance laws to protect the last wishes of a decedent whether he or she had a testate will or not. Although the tax rates remain.

Housing Tax Estate Tax Tax Rate Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Indiana Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Property Tax Prorations Case Escrow

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Estate And Inheritance Taxes

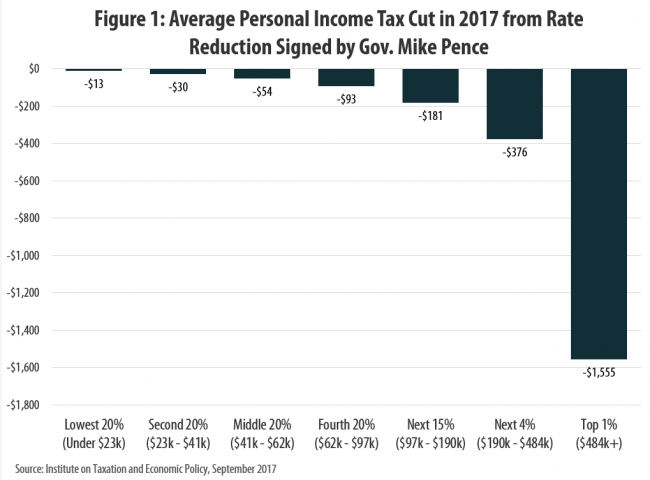

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Should I Do With My Inheritance Inside Indiana Business

Pin By The Kandi Lowe Team Remax On Everything Remax Indiana Real Estate Remax Real Estate Real Estate Marketing

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Pin By The Kandi Lowe Team Remax On Everything Remax Indiana Real Estate Remax Real Estate Real Estate Marketing

Indiana Estate Tax Everything You Need To Know Smartasset

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation